ITR-7 RETURN

Income Tax Return i.e. ITR is simply a form that has to be filed with the Income Tax Department. Some employees at the company term it an income tax return filing or an income tax filing. The main motto of online ITR filing is to make a report of income and the taxes that are paid to the government.

Who can file the ITR-7 Form ?

ITR-7 has to be filled by persons and companies who are required to furnish under section 139 (4A-4B-4C-4D-4E-4F).

Section 139 numbers along with details have been mentioned below:

Any person whose receipt of income is formed from property held which is under a trust or other legal obligation totally for charitable or religious purposes or partially for the same purpose should file a return under section 139(4A).

Any political party's total income without bringing into effect the provisions of section 139A exceeds the threshold amount which is not chargeable to income-tax should file a return under section 139(4B).

News agencies, scientific research centers, and associations, Institutions or universities, or other educational institutions referred to in section 10(23B), hospital or other medical institution, association or institution referred to in section 10(23A). These all are supposed to file returns under section 139(4C)

Any university, college, or other institution, chăm sóc người bệnh tại bệnh viện which does not have to file a return of income or loss under any other provision should file a return under section 139(4D).

Any business trust that isn't required to furnish a return of income or loss under any other provisions of should file a return under section 139(4E).

Those investment funds referred to in section 115UB should file a return under section 139(4F).

What is the Sequence for filling parts and schedules in ITR-7?

While filling out the income tax return, the Income Tax Department recommends assesses to follow the below sequence:

1) Part A

2) Part B

3) Schedules

4) Verification

How can I file my ITR-7 Form?

A taxpayer has to file ITR-6 online mandatorily. There is no offline process for ITR-7.

The ITR-7 can be filed Online/Electronically by:

Furnishing the return electronically under digital signature

You would have to transmit data electronically and then submit the verification of the return in the form of ITR-V.

After this, the assessee should print two copies of the ITR-V Form. A copy should be duly signed and then it has to be sent by ordinary post to the Electronic City Office in Bengaluru. The other copy may be kept by the assessee for his own record.

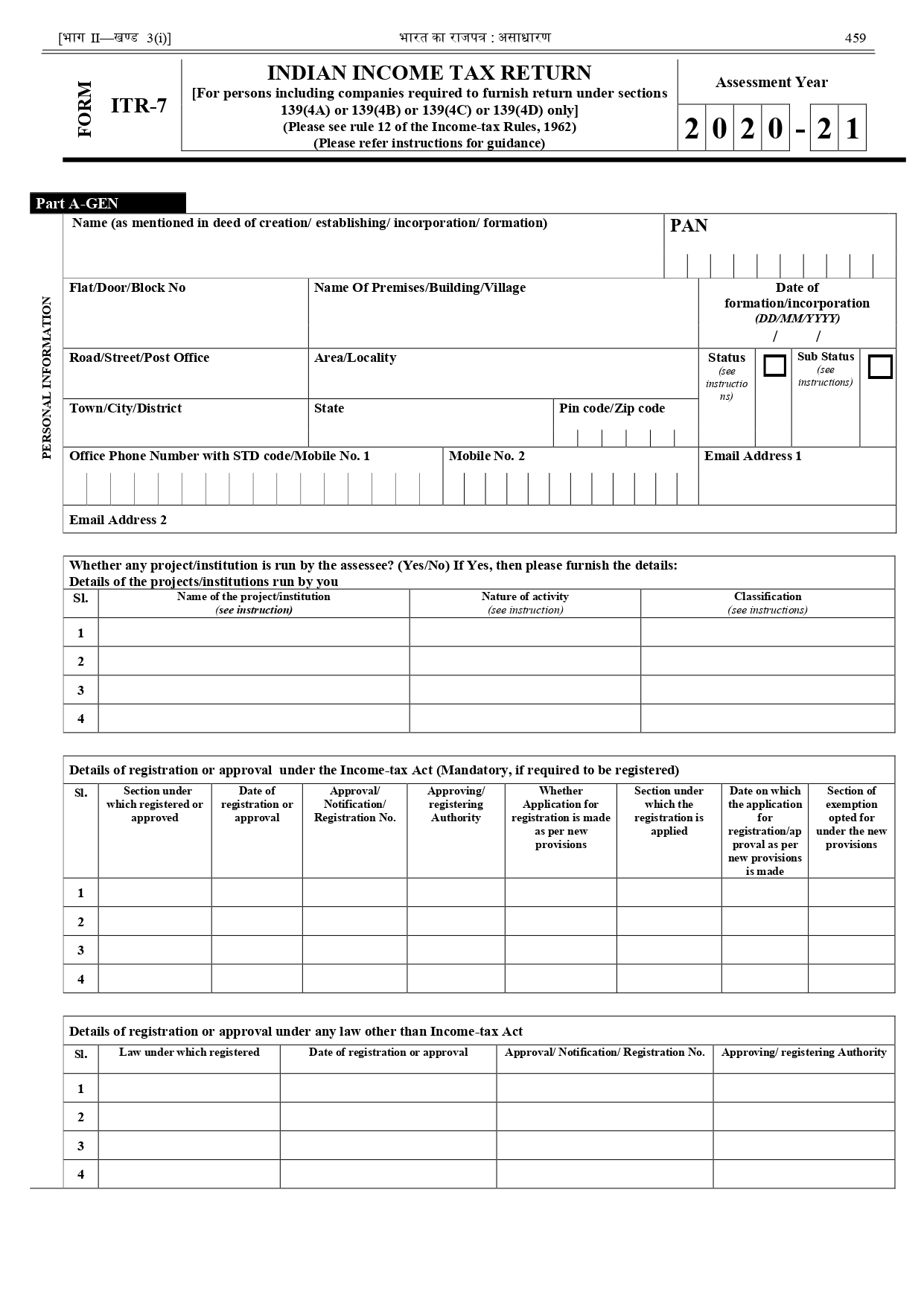

What is the structure of the ITR-7 Form for AY 2020-21?

ITR-6 Form has been divided into two categories i.e. parts and several schedules:

Part-A – General information

For the AY 2019-20, a taxpayer also has to provide information on the details of registration or approval.

Part-B – Outline of the total income and tax computation with respect to income chargeable to tax.

| Schedule-I | Details of amounts accumulated/ set apart within the meaning of section 11(2) in last year’s viz., previous years relevant to the current assessment year. |

| Schedule-J | Statement showing the investment of all funds of the Trust or Institution as on the last day of the previous year. |

| Schedule-K | Statement of particulars regarding the Author(s)/ Founder(s)/ Trustee(s)/ Manager(s), etc., of the Trust or Institution. |

| Schedule-LA | Details in case of a political party. |

| Schedule-ET | Details in case of an Electoral Trust |

| Schedule-VC | Details of Voluntary Contributions received |

| Schedule AI | Aggregate of income derived during the year excluding voluntary contributions |

| Schedule ER | Amount applied to charitable or religious purposes in India – Revenue Account |

| Schedule EC | Amount applied to charitable or religious purposes in India – Capital Account |

| Schedule IE-1, IE-2, IE-3 and IE-4 | Income and expenditure statement |

| Schedule-HP | Computation of income under the head Income from House Property. |

| Schedule-CG | Computation of income under the head Capital gains. |

| Schedule-OS | Computation of income under the head Income from other sources. |

| Schedule-OA | General information about business and profession |

| Schedule-BP | Computation of income under the head “profit and gains from business or profession |

| Schedule-CYLA | Statement of income after setting off of current year’s losses |

| Schedule PTI | Pass through Income details from business trusts or investment funds as per section 115UA, 115UB |

| Schedule-SI | Statement of income which is chargeable for tax at special rates |

| Schedule 115TD | Accredited income under section 115TD |

| Schedule FSI | Details of income accruing or arising outside India |

| Schedule TR | Details of Taxes paid outside India |

| Schedule FA | Details of Foreign Assets |

| Schedule-SH | Details of shareholding in an unlisted company |

| Part B-TI | Computation of total income |

| Part B-TTI | Computation of tax liability on total income |

Tax payments:

1. Details of payments of Advance Tax and Self-Assessment Tax

2. Details of Tax Deducted at Source (TDS) on Income (As per Form 16A/16B/16C).

3. Details of Tax Collected at Source (TCS)

Pricings

STARTUP

9989

- Gross Receipts Less Than Rs. 50 Lakhs

- Tax Planning

- Preparation of Income & Expenditure Account

- Income From Others Sources

Buy Now

Executive

19989

- Gross Receipts Less Than Rs. 1 Crore

- Tax Planning

- Audit Report

- Preparation of Income & Expenditure Account

- Income From Others Sources

Buy Now

PREMIUM

39989

- Gross Receipts More Than Rs. 1 Crore *

- Tax Planning

- Audit Report

- Preparation of Income & Expenditure Account

- Income From Others Sources

Buy Now

Advantages

-

The numbers and the capital base defined by the income tax return is helpful for the loan processing. Higher the financial worth, easier the loan processing. The same applies to high-risk cover insurance. The ITR is a considerable document for making decisions in this regard.

-

Salaried personnel receive their income after deduction of applicable TDS. It may happen that after the eligible deductions, the tax liability is lower than the amount of TDS deducted. In such cases, the excessive payment can be claimed in the form of refund only if ITR is filed by the person.

-

Most businesses in their initial years face losses from the business. The business loss or capital losses can be carried forward up to 8 years if the ITR is filed. This loss can also be adjusted against future income that lowers taxable income in the future. If ITR is not filed, the taxpayer is deprived of this benefit.

-

The ITR filed with the Government defines the financial worth of the taxpayer. The track of ITR shows the financial capacity and also increases the capital base of a person. Hence, the track value of income and financial worth is decided by the previously filed ITR. Investors and institutions look forward to returns filed to understand the capacity of the business.

Disadvantages

FAQs Section

-

ITR-7 Form cannot be used by an a taxpayer who is not claiming an exemption u/s 139 (4A), 139(4B), 139(4C) or 139(4D).

-

For all scenarios, Companies and Firms can use ITR-5, ITR-6, ITR-7.

-

ITR-7 has to be filled by persons and companies who are required to furnish under section 139 (4A-4B-4C-4D-4E-4F).

-

Yes, if the entity is required to do the audit, then it should be done by a professional CA and the audit report and date of furnishing the report should be provided along with ITR-7.

-

The due date for assessees whose accounts are required to be audited is 30th September. The due date for Assessees whose accounts are not required to be audited is 31st July.