ITR-4 RETURN

Income Tax Return i.e. ITR is simply a form which has to be filed with the Income Tax Department. Some employees at the company term it as income tax return filing or an income tax filing. The main moto of online itr filing is to make a report of income and the taxes that are paid to the government.

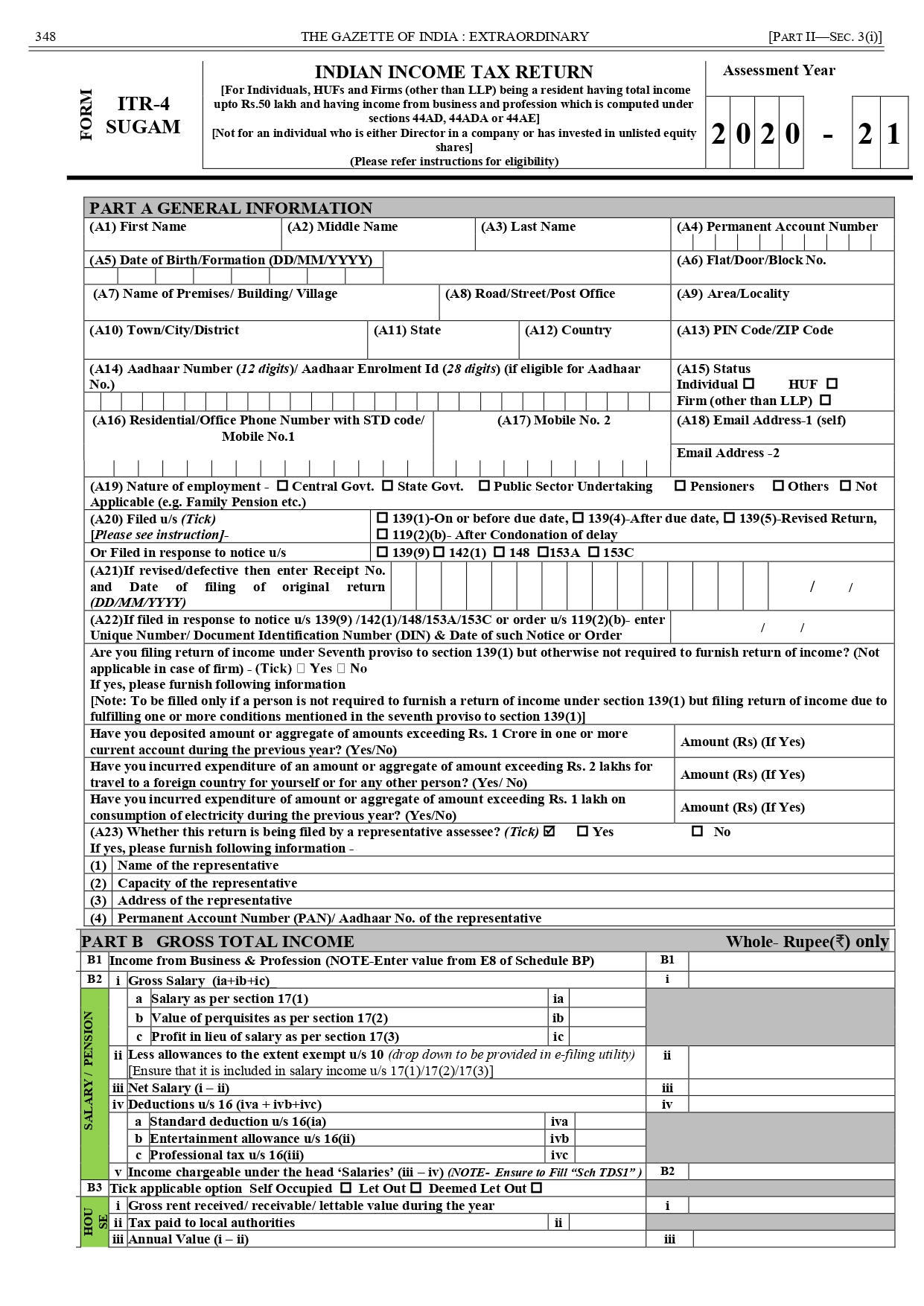

ITR-4 is also known as Sugam. The Income Tax Return Form is for the individual or resident of Hindu Undivided Family (HUF), Partnership firms (not including LPP) who are residents who have income from a business or profession.

Also those who have applied through presumptive income schemes based on Section 44AD, Section 44ADA and Section 44AE of the Income Tax Act. However, if the business turnover is more than Rs 2 crore, the taxpayer will have to file ITR-3.

People who are not eligible to file ITR-4?

If the total income exceeds Rs 50 lakh

If your income comes from more than one housing property

If you own any foreign asset

If you have any source of income from foreign country

If you are a Director in a company

If you have had investments in unlisted equity shares at any time during the financial year

If you are a resident not ordinarily a resident (RNOR) and non-resident

What is the structure of the ITR-4 Form for AY 2020-21?

| Part A | General Information. |

| Part B | Gross total income from the five heads of income. |

| Part C | Deduction and total taxable income. |

| Part D | Tax computation and tax status of taxpayers. |

| Schedule BP | Details of income from Business along with GST details and detailed financial information |

| Schedule IT | Statement of payment of advance-tax and tax on self-assessment. |

| Schedule-TCS | Statement of tax that has been collected at source. |

| Schedule TDS1 | Statement of tax that has been deducted at the source of your salary. |

| Schedule TDS2 | Statement of tax that has been deducted at a source on income other than salary. |

| Schedule DI | Statement of investments or deposits or payments for the extended period from 1 April 2020 to 30 June 2020. |

How can I file my ITR-4 Form?

Unlike ITR-3, ITR-4 Form can be submitted either through online or offline mode.

1)Offline:

The following individuals are eligible to file the return in paper form:

An individual who is 80 years or more at any time during the previous year.

An individual or HUF whose income does not exceed Rs 5 lakhs and who has not claimed any refund in the return of income

Returns can be filed offline:

For offline use, the return is issued in a physical paper form. At the time of submission you will be provided with an acknowledgement from the Income Tax Department.

Online/Electronically:

By Furnishing the return electronically under digital signature

By filing the return online and e-verifying the ITR-V through net banking/aadhaar OTP/EVC.

Since you furnished the return electronically under Digital Signature, an acknowledgement for the same will be sent to your registered email id.

After this, you are supposed to send it to the Income Tax Department’s CPC office within 120 days from the date of e-filing.

Major changes introduced in ITR 2 for AY 2020-21?

1)Return filed under section have been segregated between normal filings and filed in response to notices.

2) The ‘Schedule VI-A’ for tax deductions has been amended to include deductions under section 80EEA and section 80EEB. A drop down will be provided to enter the details of the donations under section 80G

3)In ‘Schedule BP’, gross turnover or gross receipts to include revenues from prescribed electronic modes received before the specified date.

4) Details of tax deduction claims for investments, payments or expenditures made between 1 April 2020 and 30 June 2020.

Pricings

STARTUP

2589

- Turnover Less Than Rs. 50 Lakhs

- Tax Planning

- Preparation of Financial Statement

- Income From Business and Professional

- Freelancer Income

Buy Now

Executive

4589

- Turnover Less Than Rs. 1 Crore

- Tax Planning

- Capital Gains Computation

- Preparation of Financial Statement

- Income From Business and Professional

- Freelancer Income

- Income From Share Market & Mutual Fund

Buy Now

PREMIUM

9989

- Turnover More Than Rs. 1 Crore *

- Tax Planning

- Capital Gains ComputationPreparation of Financial Statement

- Income From Business and Professional

- Freelancer Income

- Income From Share Market & Mutual Fund

- Income from Digital Assets like crypto

Buy Now

Advantages

-

The numbers and the capital base defined by the income tax return is helpful for the loan processing. Higher the financial worth, easier the loan processing. The same applies to high-risk cover insurance. The ITR is a considerable document for making decisions in this regard.

-

Salaried personnel receive their income after deduction of applicable TDS. It may happen that after the eligible deductions, the tax liability is lower than the amount of TDS deducted. In such cases, the excessive payment can be claimed in the form of refund only if ITR is filed by the person.

-

Most businesses in their initial years face losses from the business. The business loss or capital losses can be carried forward up to 8 years if the ITR is filed. This loss can also be adjusted against future income that lowers taxable income in the future. If ITR is not filed, the taxpayer is deprived of this benefit.

-

The ITR filed with the Government defines the financial worth of the taxpayer. The track of ITR shows the financial capacity and also increases the capital base of a person. Hence, the track value of income and financial worth is decided by the previously filed ITR. Investors and institutions look forward to returns filed to understand the capacity of the business.

Disadvantages

FAQs Section

-

Resident Individual, Resident HUF, Resident Partnership Firm (excluding LLP) can take benefit of this.

-

No, you need not since they are exempt from the requirements of Sec 44A to maintain books.

-

The eligible individual should opt for the scheme and then he should file his return in ITR-4.

-

ITR-4 consists of 2 components i.e. 3 Parts and 6 Schedule.