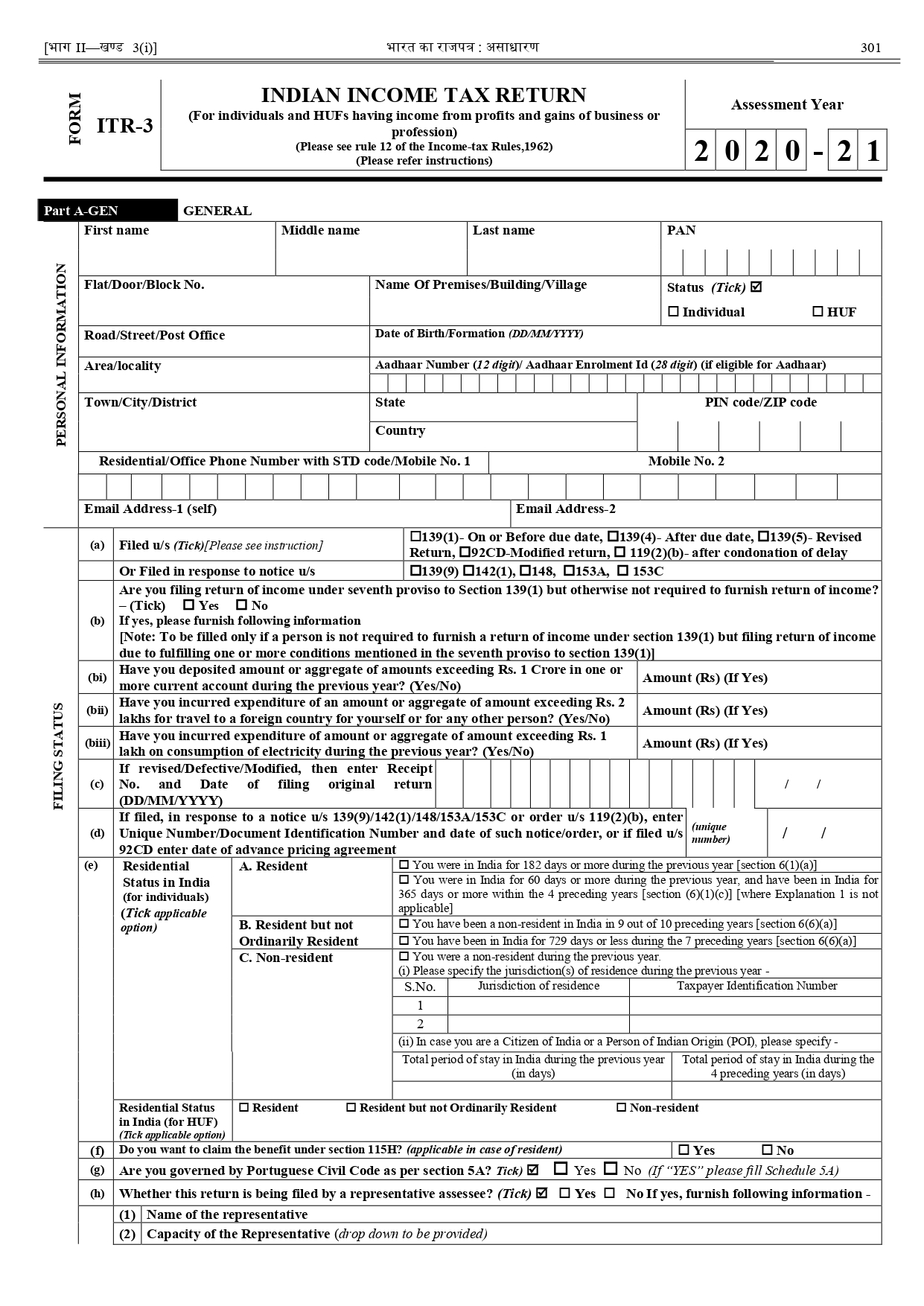

ITR-3 RETURN

Income Tax Return i.e. ITR is simply a form that has to be filed with the Income Tax Department. Some employees at the company term it an income tax return filing or an income tax filing. The main motto of online ITR filing is to make a report of income and the taxes that are paid to the government.

Who can file the ITR-3 Form ?

This Income Tax Return Form is for the individual or resident of Hindu Undivided Family (HUF) whose income from profits and gains is from business or profession.

Individuals getting income from the below-mentioned sources are eligible to file ITR 3 :

1) Having on a business or profession (both tax audit & non-audit cases)

2) Returns can include income from Housing property, Salary/Pension, capital gains, and Income from other sources

How can I file my ITR-3 Form?

A taxpayer has to file ITR-3 online mandatorily. There is no offline process for ITR-3.

The ITR-3 can be filed Online/Electronically by:

Furnishing the return electronically under digital signature

You would have to transmit data electronically and then submit the verification of the return in the form of ITR-V.

Since you furnished the return electronically under Digital Signature, an acknowledgment for the same will be sent to your registered email id.

After this, you are supposed to send an acknowledgment to the Income Tax Department’s CPC office within 120 days from the date of e-filing.

What is the structure of the ITR-3 Form for AY 2020-21?

ITR-3 is divided into:

| Part A-GEN | General information and Nature of Business |

| Part A-BS | Balance Sheet as of March 31, 2020, of the Proprietary Business or Profession |

| Part A- Manufacturing Account | Manufacturing Account for the financial year 2019-20 |

| Part A- Trading Account | Trading Account for the financial year 2019-20 |

| Part A-P&L | Profit and Loss for the Financial Year 2019-20 |

| Part A-OI | Other Information (optional in a case not liable for audit under Section 44AB) |

| Part A-QD | Quantitative Details (optional in a case not liable for audit under Section 44AB) |

| Schedule-S | Computation of income under the head Salaries. |

| Schedule-HP | Computation of income under the head Income from House Property |

| Schedule BP | Computation of income from business or profession |

| Schedule-DPM | Computation of depreciation on plant and machinery under the Income-tax Act |

| Schedule DOA | Computation of depreciation on other assets under the Income-tax Act |

| Schedule DEP | Summary of depreciation on all the assets under the Income-tax Act |

| Schedule DCG | Computation of deemed capital gains on the sale of depreciable assets |

| Schedule ESR | Deduction under section 35 (expenditure on scientific research) |

| Schedule-CG | Computation of income under the head Capital gains. |

| Schedule 112A | Details of Capital Gains where section 112A is applicable |

| Schedule 115AD(1)(iii)Provison | For Non Residents Details of Capital Gains where section 112A is applicable |

| Schedule-OS | Computation of income under the head Income from other sources. |

| Schedule-CYLA-BFLA | Statement of income after set off of current year’s losses and Statement of income after set off of unabsorbed loss brought forward from earlier years. |

| Schedule-CYLA | Statement of income after setting off of current year’s losses |

| Schedule BFLA | Statement of income after setting off of unabsorbed loss brought forward from earlier years. |

| Schedule CFL | Statement of losses to be carried forward to future years. |

| Schedule- UD | Statement of unabsorbed depreciation. |

| Schedule ICDS | Effect of Income Computation Disclosure Standards on Profit |

| Schedule- 10AA | Computation of deduction under section 10AA. |

| Schedule 80G | Statement of donations entitled for deduction under section 80G. |

| Schedule RA | Statement of donations to research associations etc. entitled for deduction under section 35(1)(ii) or 35(1)(iia) or 35(1)(iii) or 35(2AA) |

| Schedule- 80IA | Computation of deduction under section 80IA. |

| Schedule- 80IB | Computation of deduction under section 80IB. |

| Schedule- 80IC/ 80-IE | Computation of deduction under section 80IC/ 80-IE. |

| Schedule VIA | Statement of deductions (from total income) under Chapter VIA. |

| Schedule SPI-SI-IF | Income of specified persons(spouse, minor etc) include able in income of the assessee, Income chargeable at special rates, and info partnership firms in which assessee is a partner. |

| Schedule AMT | Computation of Alternate Minimum Tax Payable under Section 115JC |

| Schedule AMTC | Computation of tax credit under section 115JD |

| Schedule SPI | Statement of income arising from spouse/ minor child/ son’s wife or any other person or association of persons to be included in the income of the assessee in Schedules-HP, BP, CG and OS. |

| Schedule SI | Statement of income which is chargeable for tax at special rates |

| Schedule-IF | Information regarding partnership firms in which assessee is a partner. |

| Schedule EI | Statement of Income not included in total income (exempt income) |

| Schedule PTI | Pass through income details from a business trust or investment fund as per section 115UA, 115UB |

| Schedule TPSA | Secondary adjustment to transfer price as per section 92CE(2A) |

| Schedule FSI | Details of income from outside India and tax relief |

| Schedule TR | Statement of tax relief claimed under section 90 or section 90A or section 91. |

| Schedule FA | Statement of Foreign Assets and income from any source outside India. |

| Schedule 5A | Information regarding apportionment of income between spouses governed by Portuguese Civil Code |

| Schedule AL | Asset and Liability at the end of the year (applicable where the total income exceeds Rs 50 lakhs) |

| Schedule DI | Schedule of tax-saving investments or deposits or payments to claim deduction or exemption in the extended period from 1 April 2020 to 30 June 2020 |

| Schedule GST | Information regarding turnover/ Gross receipt reported for GST |

| Part B-TI | Computation of Total Income. |

| Part B-TTI | Computation of tax liability on total income. |

Pricings

STARTUP

2589

- Turnover Less Than Rs. 50 Lakhs

- Tax Planning

- Preparation of Financial Statement

- Income From Business And Profession

Buy Now

Executive

3589

- Turnover Less Than Rs. 1 Crore

- Tax Planning

- Capital Gains computation

- Preparation of Financial Statement

- Income From Business And Profession

- Income from F&O or IntraDay Trading

Buy Now

PREMIUM

15989

- Turnover More Than Rs. 1 Crore *

- Tax Planning

- Capital Gains Computation

- Preparation of Financial Statement

- Income From Business And Profession

- Audit of Accounts

- Income from F&O or IntraDay Trading

- Income From Crypto or Digital Assets

Buy Now

Advantages

-

The numbers and the capital base defined by the income tax return is helpful for the loan processing. Higher the financial worth, easier the loan processing. The same applies to high-risk cover insurance. The ITR is a considerable document for making decisions in this regard.

-

Salaried personnel receive their income after deduction of applicable TDS. It may happen that after the eligible deductions, the tax liability is lower than the amount of TDS deducted. In such cases, the excessive payment can be claimed in the form of refund only if ITR is filed by the person.

-

Most businesses in their initial years face losses from the business. The business loss or capital losses can be carried forward up to 8 years if the ITR is filed. This loss can also be adjusted against future income that lowers taxable income in the future. If ITR is not filed, the taxpayer is deprived of this benefit.

-

The ITR filed with the Government defines the financial worth of the taxpayer. The track of ITR shows the financial capacity and also increases the capital base of a person. Hence, the track value of income and financial worth is decided by the previously filed ITR. Investors and institutions look forward to returns filed to understand the capacity of the business.

Disadvantages

FAQs Section

-

If you are a taxpayer then the audit has been extended till 30 November from 31 October for 2020-21.

The tax audit report filing's due date has been extended to 31 October from 30 September.

-

The threshold limit for a tax audit is proposed to be increased to Rs 5 crore with effect from AY 2020-21 (FY 2019-20).

-

ITR-3 form can be filed when the assessee has income from below conditions :

1) Income from a profession:

2) Income from Proprietary Business:

3) Income from Salary/Pension, House property, and Income from other sources.

-

If an individual or HUF is working as a partner of a partnership firm that is carrying out business/profession then he cannot file ITR-3. In such a case, he is required to file ITR 2.

-

ITR-3 can be filed by individuals or HUFs who is carrying on a profession or from Proprietary business.