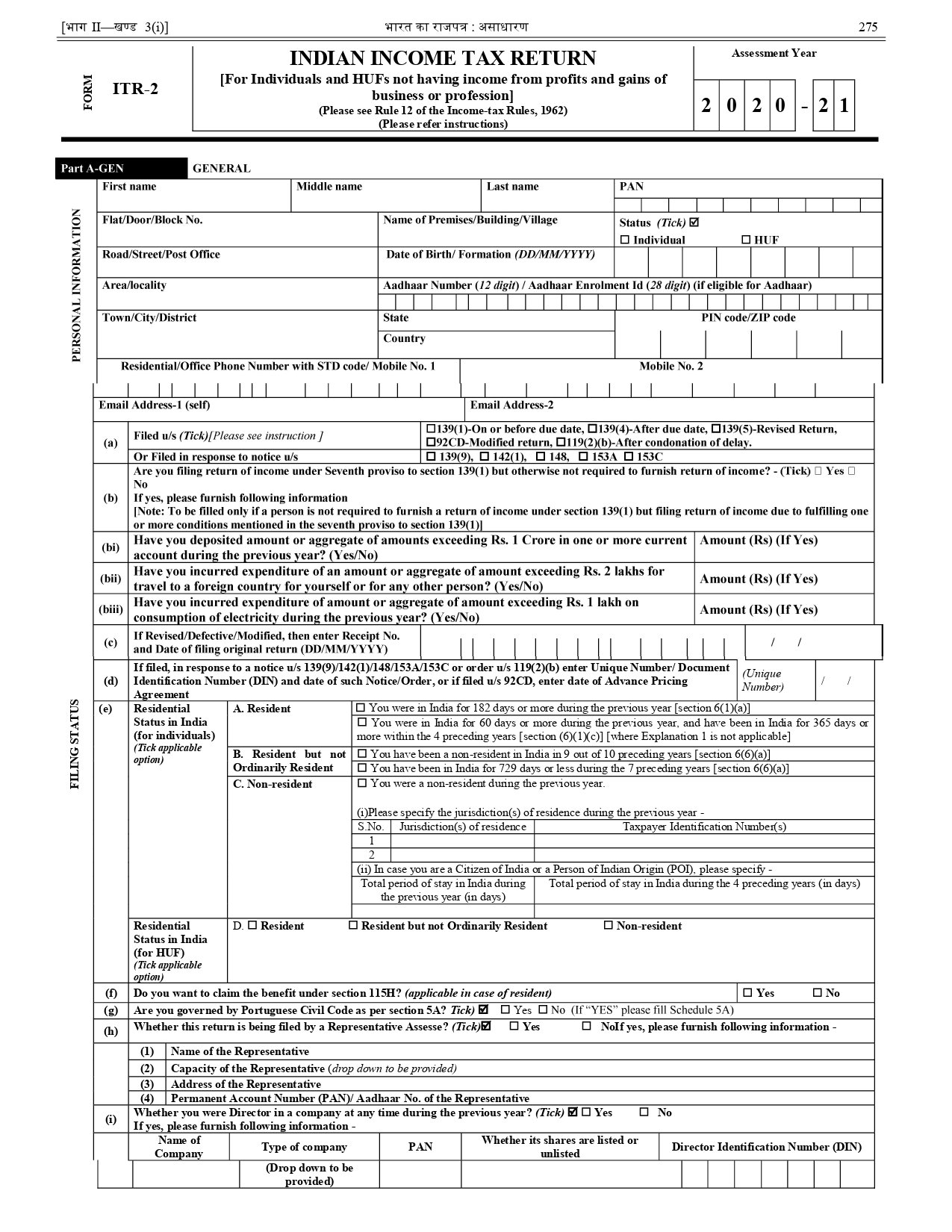

ITR-2 RETURN

Income Tax Return i.e. ITR is simply a form that has to be filed with the Income Tax Department. Some employees at the company term ITR as income tax return filing or an income tax filing. The main motto of online ITR filing is to make a report of income and the taxes that are paid to the government.

This Income Tax Return Form is for the residents of Hindu Undivided Families (HUF) whose total income for the financial year includes:

A person whose income source is in the means of Salary/Pension

A person whose source of income is from more than 1 Housing Property

Person whose income is from Capital Gains or loss on sale of investments/property.

A person whose income is from other sources like jackpot such as lottery, horse racing etc.

A person who has any form of asset in a foreign country.

A person who has any source of income from a foreign country.

A person who earns more than Rs 5000 in agricultural.

A person who is a resident is not ordinarily a resident and a Non-resident

A person who is the Director of any company and an individual who has invested in unlisted equity shares of a company will be required to file their returns in ITR-2.

People who are not eligible to file ITR-2?

1) Any individual or HUF whose income is from any Business or Profession

2) Individuals who are eligible to fill out the ITR-1 Form

How can I file my ITR-2 Form?

You can file your ITR-1 either offline or through an online process

Offline:

The following individuals are eligible to file the return in paper form:

An individual who is 80 years or more, at any time during the previous year.

Things to take care before filing ITR-2:

Furnish the return in a physical paper form.

Furnish a bar-coded return

At the time of submission you will be provided with an acknowledgement from the Income Tax Department.

Online/Electronically:

By furnishing the return electronically under digital signature

By filing the return online and e-verifying the ITR-V through net banking/adhaar OTP/EVC.

Since you furnished the return electronically under Digital Signature, an acknowledgment for the same will be sent to your registered email id.

After this, you are supposed to send it to the Income Tax Department’s CPC office within 120 days from the date of e-filing.

What is the Structure of ITR 2?

ITR-2 is divided into following sections :

| Part A | General Information |

| Schedule S | Details regarding income from salaries |

| Schedule HP | Details regarding income from Housing Property |

| Schedule CG | Computing and Figuring of income under Capital gains |

| Schedule OS | Computing and Figuring of income under Income from other sources. |

| Schedule CYLA | Statement of income after set off of current year’s losses |

| Schedule BFLA | Statement of income after unabsorbed loss brought forward from earlier years |

| Schedule CFL | Statement of losses to be carried forward to future years |

| Schedule VIA | Statement of deductions (from total income) under Chapter VIA |

| Schedule 80G | Statement of donations entitled for deduction under section 80G |

| Schedule 80GGA | Statement of donations for scientific research or rural development |

| Schedule AMT | Computing and Figuring of Alternate Minimum Tax payable under section 115JC |

| Schedule AMTC | Computing and Figuring of tax credits under section 115JD |

| Schedule SPI | Statement of income arising to spouse/ minor child/ son’s wife or any other person or association of persons to be included in the income of the assessee in Schedules-HP, CG and OS |

| Schedule SI | Statement of income which is chargeable to tax at special rates. |

| Schedule EI | Details of Exempt Income |

| Schedule PTI | Pass through income details from business trust or investment fund as per Section 115UA, 115UB |

| Schedule FSI | Statement of income accruing or arising outside India. |

| Schedule TR | Details of taxes paid outside India |

| Schedule FA | Details of Foreign Assets and income from any source outside India. |

| Schedule 5A | Statement of apportionment of income between spouses governed by Portuguese Civil Code. |

| Schedule AL | Asset and liability at the year-end (applicable in case the total income exceeds Rs 50 lakhs) |

| Schedule DI | Schedule of tax-saving investments or deposits or payments to claim deduction or exemption in the extended period from 1 April 2020 to 30 June 2020 |

| Part B-TI | Computing and Figuring of Total Income |

| Part B-TTI | Computing and Figuring of tax liability on total income. |

Major changes introduced in ITR 2 for AY 2020-21

RNORs and non-resident individuals who have an income of below Rs. 50 Lakhs also have to file their income tax return in ITR-2.

The taxpayer should disclose

1) Expenditure incurred, if any, above Rs 2 lakhs on foreign travel

2) Expenditure incurred if any, above Rs 1 lakhs of electricity.

3) The deposits above Rs 1 crore in the current accounts with a bank.

Residential individuals who own more than one housing property should also file their income tax return on ITR-2.

Any individual taxpayer with income from a business or profession cannot use ITR-2.

If the taxpayer is a director in any company or has unlisted equity investments, the ‘type of company’ has to be disclosed.

Pricings

STARTUP

1289

- Taxable Income Less Than Rs. 50 Lakhs

- Tax Planning

- Single Form 16

- Rental Income

- Agriculture Income

Buy Now

Executive

2789

- Taxable Income more Than Rs. 50 Lakhs

- Tax Planning

- Capital Gains Computation

- Multiple Form 16

- Rental Income

- Capital gain or income from share market

Buy Now

PREMIUM

6589

- Taxable Income More Than Rs. 50 Lakhs

- Tax Planning

- Capital Gains Computation

- Foreign Assets Or Foreign Income

- Multiple Form 16

- Rental Income

- Capital gain or income from share market

- Live ITR Filing with Video call/zoom/meet

- Gain from Digital Assets like Crypto

Buy Now

Advantages

-

The numbers and the capital base defined by the income tax return is helpful for the loan processing. Higher the financial worth, easier the loan processing. The same applies to high-risk cover insurance. The ITR is a considerable document for making decisions in this regard.

-

Salaried personnel receive their income after deduction of applicable TDS. It may happen that after eligible deductions, the tax liability is lower than the amount of TDS deducted. In such cases, the excessive payment can be claimed in the form of refund only if ITR is filed by the person.

-

Most businesses in their initial years face losses from the business. The business loss or capital losses can be carried forward up to 8 years if the ITR is filed. This loss can also be adjusted against future income that lowers taxable income in the future. If ITR is not filed, the taxpayer is deprived of this benefit.

-

The ITR filed with the Government defines the financial worth of the taxpayer. The track of ITR shows the financial capacity and also increases the capital base of a person. Hence, the track value of income and financial worth is decided by the previously filed ITR. Investors and institutions look forward to returns filed to understand the capacity of the business.

Disadvantages

FAQs Section

-

The allowances which may be exempt to a certain extent are as follows: HRA, LTA, transport allowance, etc. Gratuity, leave encashment, the pension may be exempt under section 10 of the Act.

-

26AS is a statement that shows various taxes that are being deducted from your income by your bank, employer, bank, tenant, etc.

-

ITR-2 has to be filed by individual and HUFs every year before 31st July.

-

ITR-2 form can be used when the assessee has income that falls under:

1) Accrued income through the sale of assets or property (Capital Gains)

2) Income from more than one housing property

3) Income from agriculture above Rs 5,000

4) Income from foreign

5) Income as a partner in any firm except proprietorship

6) Income from any lotteries or horse racing

7) Income from Salary/Pension, Housing Property, Other sources that exceed Rs. 50 Lakhs

-

The Income Tax Department has come up with the following portal www.incometaxindiaefiling.gov.in to file your income tax return.